Sometimes, when life gets particularly busy, it’s easy to make mistakes, especially when it comes to your finances.

While “to err is human”, it’s important to learn from these missteps to avoid repeating them, as doing so can prove costly in the long run.

The idea of making errors over and over again is the theme of the revered film, Groundhog Day. In the 1993 classic, Bill Murray’s character relives the same day stuck in a loop until he learns to change his behaviour.

Financial blunders can feel just like this cycle and be just as hard to break.

Since 2 February 2025 so recently marked Groundhog Day, the event that shares its name with the film, this could be the ideal time to take a closer look at five financial mistakes that are best avoided… and certainly not to be repeated.

1. Not “paying your future self first”

While budgeting is one of the cornerstones of good financial planning, it can be surprisingly challenging to get right.

As an example, imagine you have £5,000 to spend each month. After covering your mortgage and bills (£2,500, say), paying for essentials such as food and travel (£1,000), and indulging in discretionary expenses (another £1,000), you’d be left with £500.

You may intend to save or invest this £500 at the end of the month, but this approach could backfire. It’s easy to overspend and find you have little left to put aside.

As such, you might want to “pay your future self first” by contributing regular amounts to your savings as soon as your pay lands in your account, rather than at the end of the month.

This ensures that your financial goals take priority, all while helping you to build a consistent saving habit. Over time, this could make a significant difference in helping you reach your financial milestones.

2. Paying only the minimum into your pension each month

If money is tight, or funds are required elsewhere, you might find that you regularly pay only the minimum amount into your pension each month.

While you’re at least contributing something, it might not be enough to secure the retirement lifestyle you dream of.

Increasing your contributions now could give your fund an initial boost while allowing you to benefit from increased tax relief.

The Annual Allowance is the total amount you can contribute to your pension tax-efficiently in a single tax year; it includes personal and employer contributions, as well as tax relief.

For 2025/26, it stands at £60,000, or 100% of your earnings, whichever is lower.

Tax relief sees the government “top up” pensions when you contribute, so a £100 contribution would only “cost” basic-rate taxpayers £80.

Meanwhile, it would only “cost” higher- or additional-rate taxpayers £60 or £55, respectively, so long as they claim the extra relief through their self-assessment tax return.

Taking proactive steps to increase pension contributions now could bolster your fund, helping to support your ideal lifestyle in retirement.

3. Relying on borrowing when the unexpected strikes instead of saving an emergency fund

You can’t ever know when an unexpected expense is right around the corner. Whether it’s a sudden car repair, a broken boiler, or even lost income during a period of illness, you may find that you rely on borrowing to cover costs if you’re unprepared.

But high-interest debt from credit cards, for example, can quickly snowball, resulting in financial stress and eroding your peace of mind.

Instead, it might be prudent to build an emergency fund of between three and six months’ worth of essential household expenses in an easy access savings account.

If you’re self-employed, retired, or have many dependants, you might want to save between one and two years of expenses.

This financial safety net means you’re more able to handle unexpected costs without needing to rely on debt or dipping into savings and investments.

Beyond the practical benefits, your emergency fund can offer invaluable peace of mind, knowing you’re prepared for the future.

4. Panic-selling during periods of downturn

Even though volatility is an inherent part of investing, you might be tempted to follow your emotions during periods of downturn and sell your investments.

This could be due to a desire to cut your losses, but remember that it’s “time in the market, not timing the market” that counts. A knee-jerk sale of shares during a market dip could inadvertently affect the long-term performance of your portfolio.

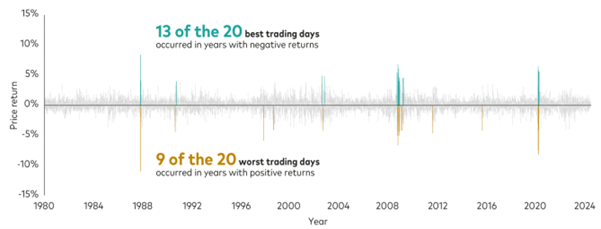

Take the chart below, for example, which shows the 20 best (represented by cyan bars) and worst (the orange bars) trading days since 1 January 1980.

Source: Vanguard

As you can see, the market’s best and worst days often occurred close together, so if you rush to sell shares after a downturn, you won’t be invested when the markets recover.

While it’s normal to feel concerned during periods of downturn, it’s often wise to remain invested and stay the course.

5. Staying silent about financial worries rather than discussing them

Money remains a taboo topic for many in the UK, even though communication can help you deal with your worries.

Research from Virgin Money UK shows that only 56% of Brits feel comfortable discussing money with their friends.

Even if you feel awkward bringing up your concerns, or shame at the mistakes you’ve made, you shouldn’t let this deter you from speaking with friends, family, or peers.

A simple chat could actually lift a weight from your mind, allowing you to see things from a new perspective. Otherwise, worries could just build up in your head until they seem impossible to deal with.

Similarly, you might also want to talk through your worries with a financial planner. They could help you deal with the issues that cause you the most concern and suggest ways to tackle the errors you constantly find yourself making.

If you’d like this invaluable support, email me on a.douglass@grosvenorconsultancy.co.uk or call my office on 01793 766 123. Alternatively, call my mobile on 07525 177 046.

While I offer high standards of service and will work with you to ensure any plan is right for you, I’m also a busy mum, so work Mondays and Tuesdays only.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.